On January 17, 2025, the Reserve Bank of India (RBI) decided to throw a regulatory yorker at India’s financial entities (FEs)—banks, NBFCs, mutual funds, and beyond— it brought out a notification stating that all FEs must now use the 140 and 160 series numbers for telephonic commercial communications. And the deadline: 31 March 2025 – less than two months from the date of the notification.

If you are responsible for voice services in an FE, you probably lost a little color and had your blood pressure rise just a little bit – this is not just a number swap—it’s a top-to-bottom redo of voice systems, consent protocols, and customer trust strategies, all to be re-worked in less than 60 days!

In 2023-2024, RBI reported ₹13,930 crore lost to bank fraud in 2023-24, and the hope is that this will stem the tide of ever–increasing scams.

For customers, this is great! Very simply, transactional calls (think OTPs or balance alerts) must now use the “1600” series, while promotional offers are confined to the “140” series. From April onwards, if you get a call from “RBI”, or “Bajaj Finance” or “HDFC Bank” and the number does not start with 160 or 140, you know it’s a scam! And if it is from 140 or 160, then you know it’s real!

A little background on 140 & 160 series

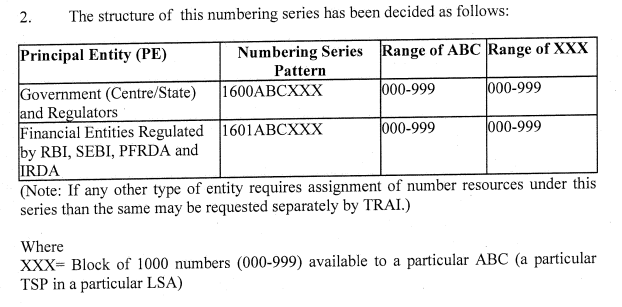

The 140 and 160 series, birthed by the Department of Telecommunications (DoT) and TRAI, are no random digits. Introduced under the Telecom Commercial Communications Customer Preference Regulations (TCCCPR), 2018, the 140 series (rolled out July 2024) tags promotional calls—credit card upsells, insurance pitches—while the 160 series (launched May 2024) is reserved for service/transactional needs. Telecom service providers (TSPs) like Jio, Airtel, and Vodafone Idea distribute them. As an FE, you can apply via your TSP, submitting entity details and call purpose. TSPs then assign numbers—1601ABCXXX (AB for telecom circle, C for operator, XXXXX unique) for transactional, or 140XXX for promo—post-verification. It’s a structured anti-spam shield, but the details are challenging for voice admins racing to retool call centers.

India hosts over 1,500 RBI-regulated entities: 91 commercial banks, 43 regional rural banks, 12 small finance banks, 6 payments banks, and 1,300+ NBFCs with customer-facing ops. Roughly 1,200 (80%) rely on outbound calls, dialing millions daily. Number availability? Rather small – each TSP, across 22 circles (Licensing Service Area, DOT lingo) can issue exactly 1000 numbers per 1600ABC prefix (e.g., 160111CXXX for Delhi). And exactly 8 TSPs have been allowed.

In sum, 8000 numbers per circle are available per circle and we have 22 circles, which comes to 1.76 lakh numbers available – yes, not too many.

How many numbers can an FE snag?

You’re not capped at one—FEs can request multiple 1600XX or 140 numbers based on operational needs, like separate lines for OTPs, customer service, or regional branches. TSPs allocate them per application, assessing volume and purpose (e.g., a bank with 10 million customers might need dozens). However, TRAI and DoT expect judicious use—hoarding isn’t an option, and each number must be DLT-registered and justified. Scalability’s there, but it’s a balancing act for admins juggling cost, capacity, and compliance. Yet, securing them by March 31, registering on the DLT platform, and syncing with TRAI’s rules could bottleneck the process. Especially when it comes to consent…

Yes, consent is the real beast!

FEs must use TRAI’s Digital Consent Acquisition (DCA) system, sending a one-time SMS or IVR— “Reply YES for updates”—to secure explicit opt-ins, logged on DLT’s blockchain ledger. Transactional 160 calls skirt prior consent for essentials, but promotional 140 calls demand it. Storage is digital, auditable, and TSP-integrated; tracking requires real-time API sync to monitor opt-ins/outs. Slip up, and penalties loom—number suspension or a two-year blacklist.

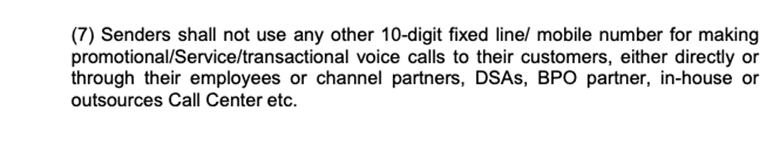

Got consent? Don’t grab just any phone. Even with a customer’s “YES,” you can’t dial from regular 10-digit numbers. RBI and TRAI mandate strict use of 1600XX for transactional calls and 140 for promotional ones—period. This traceability ensures customers recognize legitimate calls and curbs spoofing, a key driver of fraud. Voice admins must overhaul systems to route every outbound call through these designated series, or risk regulatory wrath and customer confusion.

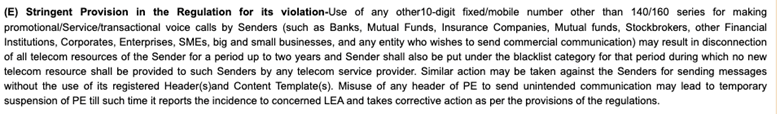

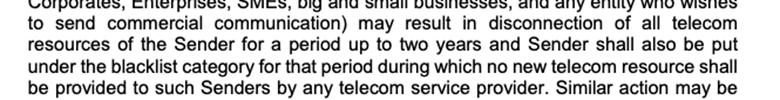

The price for non-compliance is high!

Non-compliance with TCCCPR, 2018, means that the DoT will impose penalties – number suspension or a two-year blacklist. In addition, RBI adds its own heat: under the Banking Regulation Act, 1949, fines up to ₹1 crore or operational curbs could hit laggards.

Personally, I hope and pray things get done by March 31, and we have a smooth move to the new regime, but I am mostly leaning on the ‘pray’ part of it – as of now, there seems to be quite a bit of confusion around this move. And to help companies handle this move, we at Assertion will release content from time to time on the questions that we have encountered in the market – so stay logged in.